Announcing the 2025 edition of the DoW PEO Directory. Online here.

Think of this PEO Directory as a “Who buys in the government?” phone book.

Finding a customer for your product in the Department of War is hard: Who should you talk to? How do you get their attention? What is the right Go-To-Market Strategy? What is a PEO and why should I care?

Ever since I co-founded Hacking for Defense, my students would ask, “Who should we call in the DoW to let them know what problem we solved? How can we show them the solution we built?” In the last few years that question kept coming, from new defense startups and their investors.

At the same time, I’d get questions from the new wave of Defense Investors asking, “What’s the best “Go-To-Market (GTM)” strategy for our startups?

PEOs, PMs, PIAs, PoRs, Consortia, SBIRs, OTAs, CSOs, FAR, CUI, SAM, CRADAs, Primes, Mid-tier Integrators, Tribal/ANC Firms, Direct-to-Operator, Direct-to-Field Units, Labs, DD-254… For a startup it’s an entirely new language, new buzzwords, new partners, new rules and it requires a new “Go-To-Market (GTM)” strategy.

How to Work With the DoW

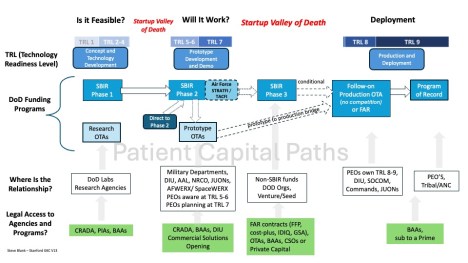

Below are simplified diagrams of two of the many paths for how a startup can get funding and revenue from the Department of War. The first example, the Patient Capital Path, illustrates a startup without a working product. They travel the traditional new company journey through the DoW processes.

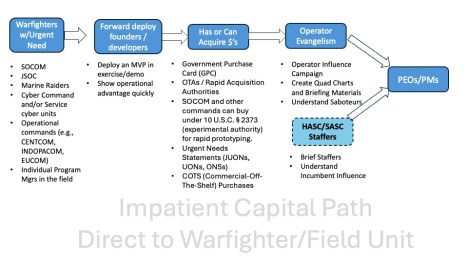

The second example, the Impatient Capital Path, illustrates a startup with an MVP and/or working product. They ignore the traditional journey through the DoW process and go directly to the warfighter in the field. With the rise of Defense Venture Capital, this “swing-for-the fences” full-speed ahead approach is a Lean Startup approach to become a next generation Prime.

(Note that in 2025 selling to the DoW is likely to change – for the better.)

Selling to the DoW takes time, but a well-executed defense strategy can lead to billion-dollar contracts, sustained revenue, and technological impact at a national scale. Existing defense contractors know who these DoW organizations are and have teams of people tracking budgets and contracts. They know the path to getting an order from the Department of War. But startups?

Why Write the PEO Directory?

Most startups don’t have a clue where to start. And selling to the Department of War is unlike any enterprise or B-to-B sales process founders and their investors may be familiar with. Compared to the commercial world, the language is different, the organizations are different, the culture of risk taking (in acquisition) is different, and most importantly the go-to-market strategy is completely different.

Amazingly, until last year’s first edition of the PEO directory there wasn’t a DoW-wide phone book available to startups to identify who to call in the War Department. This lack of information made sense in a world where the DoW and its suppliers were a closely knit group who knew each other and technology innovation was happening at a sedate decades-long pace. (And assumed our adversaries didn’t have access to our DoW web pages, LinkedIn and ChatGPT.)

That’s no longer true. Given the rapid pace of innovation outside the DoW, and new vendors in UAS, counter UAS, autonomy, AI, quantum, biotech, et al, this lack of transparency is now an obstacle to a whole-of-nation approach to delivering innovation to the warfighter.

(This lack of information even extends internally to the DoW. I’ve started receiving requests from staff at multiple Combatant Commands for access to the PEO Directory. Why? Because “…it would be powerful to include a database of PEOs to link to our database of Requirements, Gaps, and Tracked Technologies to specific PEOs to call.”)

This is a classic case of information asymmetry, and it’s not healthy for either the increasingly urgent needs of the Department of War or the nascent startup defense ecosystem.

Our adversaries have had a whole-of-nation approach to delivering innovation to the warfighter in place for decades. This is our contribution to help the DoW compete.

2025 PEO Directory Edition Notes

The first edition of this document started solely as a PEO directory. Its emphasis was (and is) the value of a startup talking to PEOs early is to get signals on what warfighter problems to solve and whether the DoW will buy their product now or in the future. Those early conversations answer the questions of “Is there a need?” and “Is there a market?”

This 2025 edition of the PEO Directory attempts to capture the major changes that are occurring in the DoW – in organizations, in processes and in people. (For example, the PEO offices of the three largest new defense acquisition programs — Golden Dome, Sentinel and Columbia – will report directly to the Deputy Secretary of War, rather than to their respective Services. And the SecWar killed the cumbersome JCIDIS requirements process.)

What this means is that in 2025 the DoW will develop a new requirements and acquisition process that will identify the most urgent operational problems facing the U.S. military, work with industry earlier in the process, then rapidly turn those into fielded solutions. (That also means the Go-to-market description, people and organizations in this document will be out of date, and why we plan to update it regularly.)

What’s New?

This 2025 edition now includes as an introduction, a 30-page tutorial for startups on how the DoW buys and the various acquisition and funding processes and programs that exist for startups. It provides details on how to sell to the DoW and where the Program Executive Offices (PEOs) fit into that process.

The Directory now also includes information about the parts of the government and the regulations that influence how the DoW buys – the White House Office of Management and Budget (OMB), and the Federal Acquisition Regulations (FAR). It added new offices such as Golden Dome Direct Reporting Program, DIU, AFRL, DARPA, MDA, CDAO, OSC, IQT, Army Transformation and Training Command, SOCOM, and others.

To help startups understand the DoW, for each service we added links to the organization, structure, and language, as well as a list of each Service’s General Officers/Flag Officers.

Appendix B has a linked spreadsheet with the names in this document.

Appendix C has a list of Venture Capital firms, Corporate Investors, Private Equity firms and Government agencies who invest in Defense. In addition, the Appendix includes details about the various DoW SBIR programs, a list of OTA Consortia, Partnership Intermediary Agreement (PIA) Organizations, and Tribal/Alaska Native Corporation (ANC) Companies.

Appendix D now lists and links to the military and state FFRDC test centers where startups can conduct demos and test equipment.

Appendix E added a list and links of Defense Publications and Defense Trade Shows.

Appendix F has a list of all Army system contractors.

A few reminders:

- This is not an official publication of the U.S. government

- Do not depend on this document for accuracy, completeness or business advice.

- All data is from DoW websites and publicly available information.

Thanks to this year’s partners helping to maintain and host the Directory: Stanford Gordian Knot Center for National Security Innovation, America’s Frontier Fund and BMNT.

This edition of the PEO Directory is on-line so it can be updated as the latest changes become available.

Send updates and corrections to updates@americasfrontier.com

You can access and download the full document here.

Filed under: Corporate/Gov’t Innovation, Gordian Knot Center for National Security Innovation, Hacking For Defense, National Security, Technology Innovation and Great Power Competition, Venture Capital |